ETFWorld

09-Apr-25CLO resilience amidst volatile markets

16-Apr-25ETFWorld

09-Apr-25CLO resilience amidst volatile markets

16-Apr-25Press Release

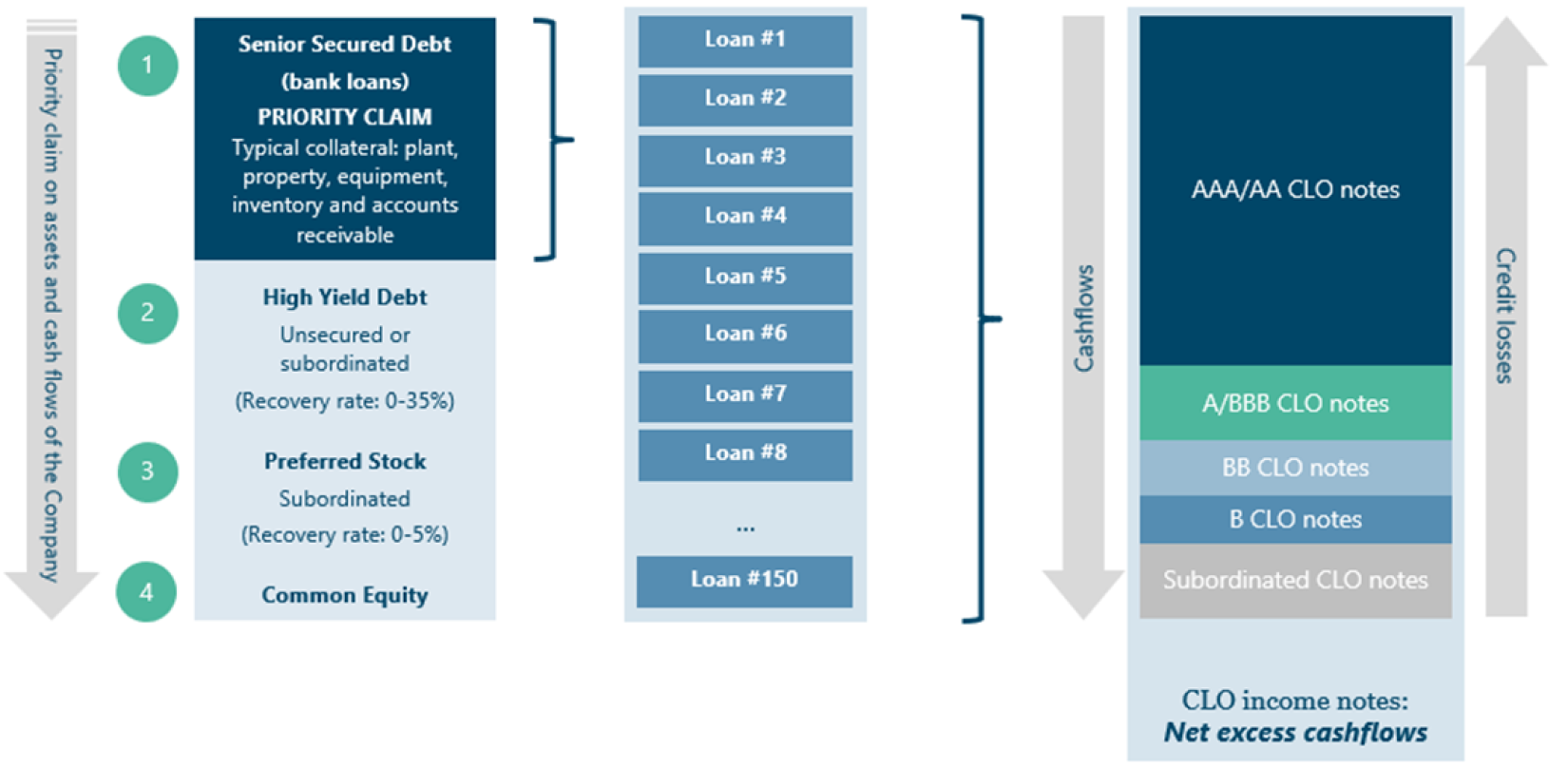

Fair Oaks Capital brings ETF investors USD hedged exposure to global AAA-rated CLOs

Fair Oaks Capital has listed a USD Hedged Acc. share class of its AAA CLO ETF, on Deutsche Börse Xetra. Trading began on Monday, April 7, 2025, under the ticker UAAA, with a denomination size of 10 USD. The Fair Oaks AAA CLO ETF originally launched in September 2024 as Europe’s first CLO ETF, pioneering access to AAA-rated, floating-rate CLO notes in an UCITS ETF wrapper.

The ETF is actively managed with an unconstrained global investment universe, enabling exposure to AAA-rated CLOs in both US and European markets. The portfolio management team, led by Miguel Ramos Fuentenebro and Roger Coyle, has been managing the fund since 2019, exclusively investing in EU risk-retention compliant senior CLOs.

“We are thrilled to broaden our CLO ETF offerings to include dollar-based investors, an investor base who has clearly demonstrated a demand for CLO opportunities,” commented Miguel Ramos Fuentenebro. “Providing access to AAA-rated CLOs through an actively managed and hedged approach offers a uniquely compelling investment opportunity. With our CLO ETF, dollar investors can access the most attractive opportunities in the CLO market, be that in the US or in Europe.”

The Fair Oaks CLO ETF was launched on the Alpha UCITS fund platform as an additional listed share class of an existing Fair Oaks UCITS fund, the Fair Oaks AAA CLO Fund, initially launched in 2019. The Fund invests exclusively in AAA-rated CLOs, based on Fair Oaks' established investment processes. The Fair Oaks AAA CLO ETF is a long-only portfolio with no leverage used at fund level and is classified as Article 8 under the EU Sustainable Finance Disclosure Regulation (SFDR).

The total expense ratio for the USD Hedged Acc. share class of Fair Oaks AAA CLO ETF is 0.35 percent.