Whitepapers

NOVEMBER 2025 • 8 MINUTE READ

Are investors mispricing "tail" volatility in AAA CLOs?

While investors overwhelmingly choose highly rated corporate bonds for fixed income investments, they may be overestimating the volatility and risk of AAA CLOs, forfeiting the enhanced return potential and proven stability of these instruments over AA corporates.

SEPTEMBER 2025 • 5 MINUTE READ

One Year In

10th September marked the one-year anniversary of the launch of Fair Oaks AAA CLO ETF (FAAA) – the first European CLO ETF. While it has been a remarkably busy first year, there is still further to go as we look to expand the investor base in European CLO ETFs.

JULY 2025 • 12 MINUTE READ

Finding liquidity at the core

By understanding the roll of the primary ETF market, investors can better grasp the true liquidity of CLO ETFs and how those ETFs are able to provide efficient access to the underlying AAA CLO market at minimal cost.

JUNE 2025 • 10 MINUTE READ

Correcting CCC confusion

The CCC excess is a little complicated and that unfortunately can create confusion when generalists comment or write about it in the press. However, for those willing to take time to understand the dynamics, it becomes clear that the CCC excess is not a forced liquidation trigger but rather a pre-emptive measure aimed at offering additional protection to CLO debtholders.

JANUARY 2025 • 5 MINUTE READ

CLO markets and ETFs

The CLO market's public trading infrastructure, price transparency, and institutional framework make it fundamentally different from private markets. CLO ETFs represent not a forcing of private assets into liquid structures but rather an efficient way to access an established, liquid market through familiar investment vehicles.

DECEMBER 2024 • 5 MINUTE READ

Floating above the rest

In the current financial landscape, investors are constantly seeking assets that offer an optimal balance of yield, safety, and stability. European AAA-rated CLOs can offer unique combination of benefits that set them apart from other fixed-income assets.

NOVEMBER 2024 • 7 MINUTE READ

A new way to invest in AAA CLOs

CLO ETFs have become increasingly popular in the US, given the structural benefits and higher return profile of CLOs all within the accessibility and tradability of an ETF wrapper. Fair Oaks brings this asset class and structure to Europe in the form of European CLO ETFs.

NOVEMBER 2024 • 12 MINUTE READ

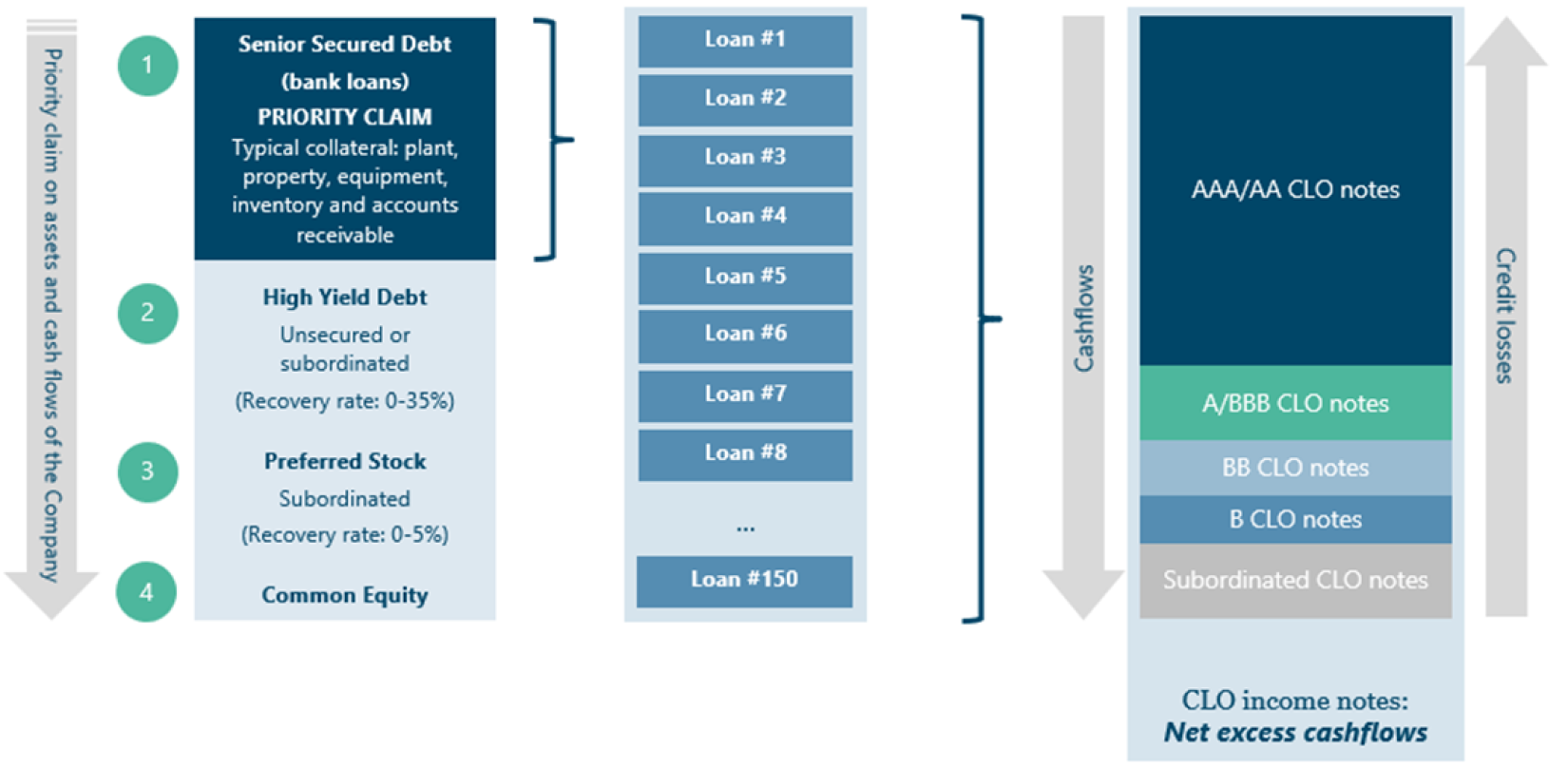

Introduction to CLO debt

Traditionally, the CLO market was largely reserved for institutional investors such as banks and pension funds. Given the CLO market's growing size and efficient trading, more open-ended funds have offered exposure to CLOs in recent years.

Register for emails from Fair Oaks Capital

Stay up to date with the latest CLO market insights and news from Fair Oaks Capital