Correcting CCC confusion

02-Jun-25The DESK

05-Jun-25Correcting CCC confusion

02-Jun-25The DESK

05-Jun-25May 2025

The CLO Investor

Busting the CLO CCC Myth

Whenever there is a period of macro volatility a predictable article tends to come out in the broader financial press. It typically goes along the lines of:

[insert negative macro event] is predicted to cause a spike in CCC loans in CLOs. This will cause them to breach their 7.5% limits and force the CLO managers to sell their CCC loans at distressed prices.

It’s an enticing premise – any forced selling of low-priced assets usually is – however, it’s incorrect as it’s just not how the CCC tests work in CLOs

Also, despite these articles, no AAA-rated CLO has ever defaulted in over 25 years (when rating agency data first started being collected).1 As we have mentioned before, this is a track record that covers multiple crises including the Global Financial Crisis, Eurozone crisis, and COVID. So why, despite these headlines, do AAA-rated CLOs have a clean track record of zero defaults and how do CCCs fit in?

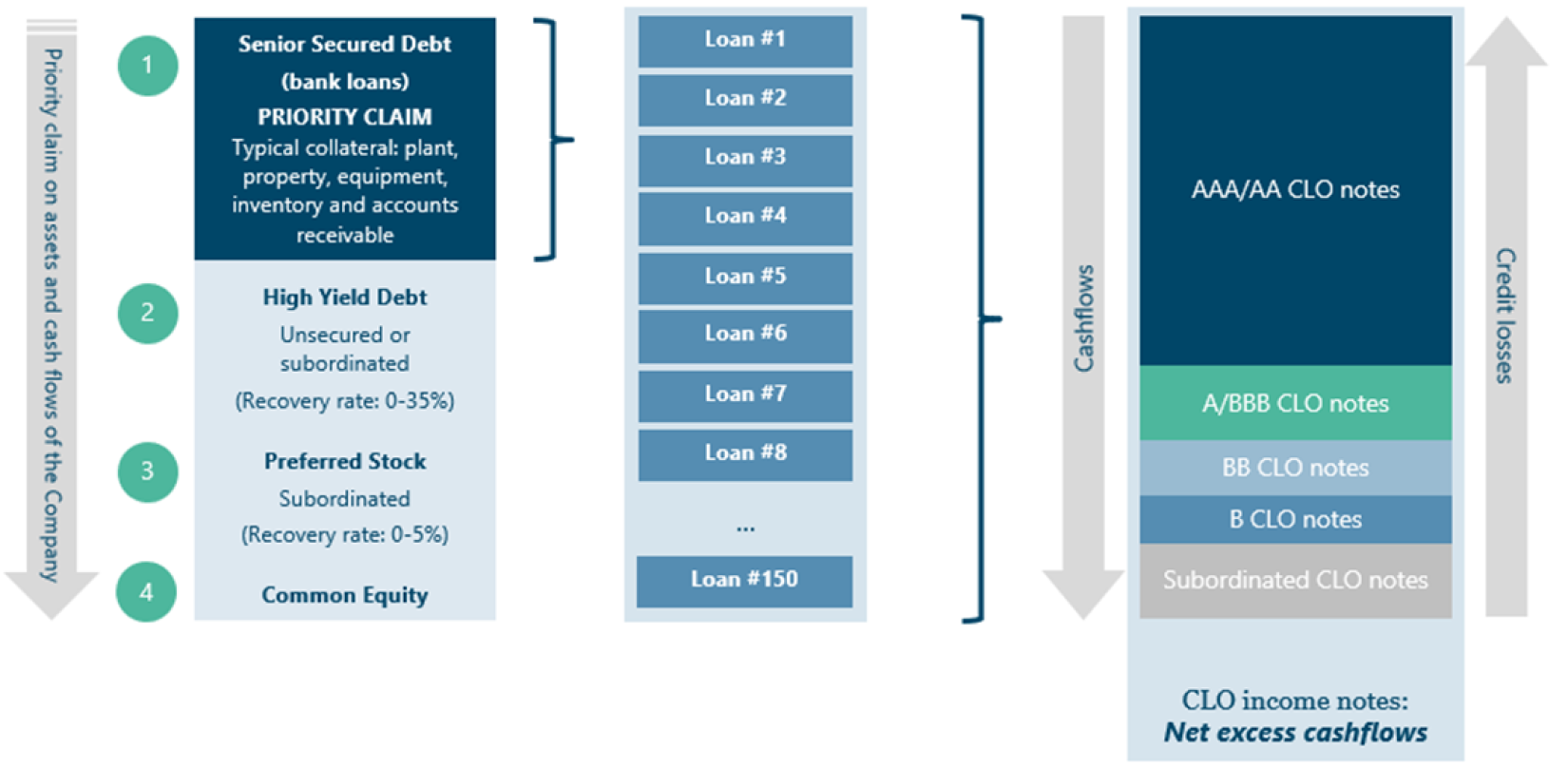

CLOs are designed and have been tested to weather periods of market volatility. They’ve achieved this record, in part, because they are non-mark-to-market structures (there are no margin calls on CLO debt) and because of numerous tests built into the structure. These tests aim to ensure there is sufficient loan collateral to protect the CLO investors throughout the lifecycle of the deal. CLO debt notes are designed to be ‘over-collateralised’ – there are more assets (underlying loans) backing the note investment than is owed on that investment. Many people will be familiar with the example of a mortgage whereby a bank typically lends less than the property is worth. This provides the bank with a cushion to receive their money back in the event of a mortgage default as the property can decrease in value and still be worth enough to pay the mortgage back in full.

In CLOs, a typical deal may have €225m AAA debt but €375m assets backing them. This provides a similar cushion for the AAA investors. In a simplified example, the assets could experience €150m of losses before they are worth less than the amount owed on the AAA-rated CLO debt.

The benefit of over-collateralisation

To consistently measure this over-collateralisation, each CLO specifies a series of over-collateralisation tests. These all work in a similar way. You take the total amount of assets in the deal (the underlying loans) and divide it by the CLO debt (e.g. the AAA tranche). We call this an over-collateralisation ratio (OC Ratio). If the OC ratio is above this limit, the test passes. If it is below the limit, then cash flows that would have been paid to the subordinated notes (equity) of the CLO get redirected to increase the ratio back to an acceptable level.

To ensure the CLO protects noteholders from a buildup of lower quality loans, the OC ratio may be impacted by the current level of CCC’s in a deal. While the CCC bucket in a typical CLO is set at 7.5%, it is important to note that this is a pre-emptive provision. If exceeded, it is only the excess above 7.5% that is measured differently in the OC ratio calculation by being included at market value rather than at par value. We can distill the impact of CCCs on this test in three brief takeaways:

-

The 7.5% CCC number matters in that it is the percentage at which the OC ratio test cushions will start decreasing in a deal, but it is not a hard limit at which CLO managers must sell loans.

-

7.5% is not the number at which cashflows will always divert. Fair Oaks’ modelling of a recent CLO transaction shows the CCC percentage will have to rise to more than 15% to trigger a diversion.2

-

Even if the CCC balance climbs, the CLO is not forced to sell loans – while the manager may elect to sell because they think the value of those loans will deteriorate further, this is an active choice. If they decide to do nothing and the CCC balance climbs to a sufficiently high level, the CLO debt protections will automatically kick-in and redirect cashflows from the equity to the AAA investor.

The CCC excess is a little complicated and that unfortunately can create some confusion when generalists comment or write about it in the press. Importantly, the CCC excess is not a forced liquidation trigger but rather a pre-emptive measure aimed at offering additional protection to CLO debt investors. These tests protect CLO investors and have resulted in the robust credit performance observed over the last 25 years!

If you are looking for additional details about how CCCs impact a CLO’s cashflow waterfall please read our whitepaper, Correcting CCC confusion: understanding the impact of CCC assets on CLOs.

Should you have any queries, please do not hesitate to contact us.

Endnotes

- S&P's, "Default, Transition, and Recovery: 2023 Annual Global Leveraged Loan CLO Default And Rating Transition Study", 27-Jun-24.

- Fair Oaks Capital as at 09-May-25. Illustrative example using Trinitas Euro 9 CLO. Analysis assumes CCC trading price of 50c.